Short History of GE

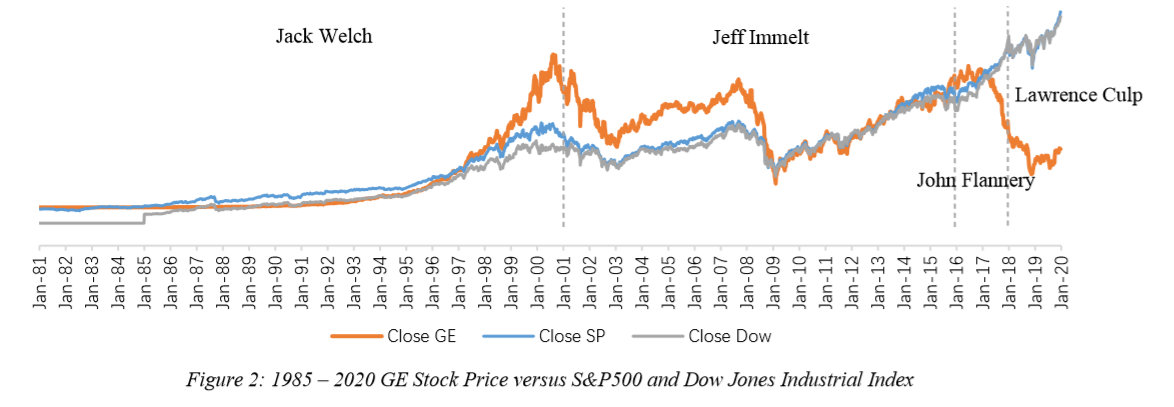

General Electric (GE) is a multi-national company in many industries, and has a successive surge in stock price from 1997 to 2000. Jack Welch has spent all his career life in GE and has been the sitting CEO from 1981 to 2001, making GE’s return much beyond S&P500 and Dow Jones Industrial.

Incorporated in 1892 by acquiring all assets of the Thomas Alva Edison and two other electrical companies, GE is one of the largest and most-diversified corporates in the world. Locating the headquarter in Boston, it provides products across many functions, including electrical and electronic equipment, aircraft engines, and financial services. GE has projected its business into eight divisions, namely GE Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation, Lighting and GE Capital. The former seven divisions are summed up into “Industrial Segment”, providing industrial products, and the latter division, GE Capital, is subject to “Financial Segment”, offering financial service in industry.

See From Stock Price Angle

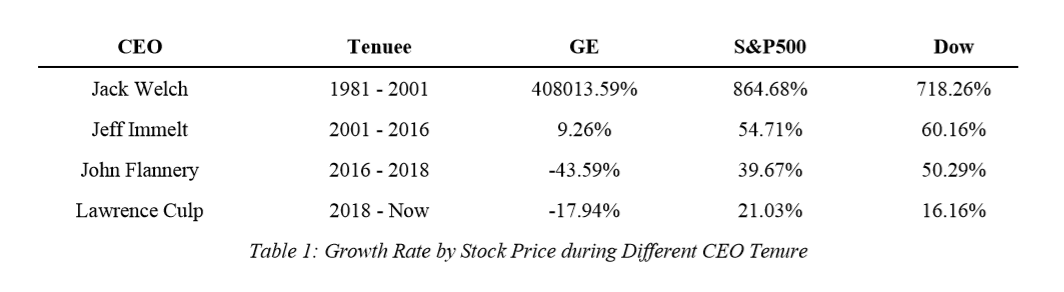

Gauged in a metric of stock price which shows the views from investors in the capital market, GE has experienced a process of four stages.

- From 1981 to 2001, it is a Jack Welch era for GE’s Fast-Growing stage, with stock price increasing 408013.59% while S&P500 increasing 864.68% and Dow Jones Industrial increasing 718.26%.

- From 2001 to 2016, Jeff Immelt has managed the company for its Average Above stage, with a 9.26% price increment lower than S&P500 54.71% and Dow Jones Industrial 60.16%.

- From 2016 to 2018, with a Plummet stage of GE, John Flannery has been the sitting CEO. Stock price has changed -43.59% for its activist investor ruling (Steve, 2017), meanwhile, S&P500 has increased 39.67% and Dow Joins Industrial has increased 50.29%.

- From 2018 to present, Lawrence Culp is taking the company, leading a -17.94% change in its stock price, while S&P500 has changed 21.03% and Dow Jones Industrial has changed 16.16% (Yahoo, 2020).

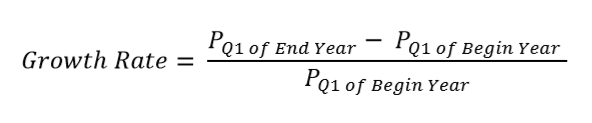

The calculation of growth rate is based on the quarterly averaged close price, denoted as P, and is calculated in each CEO’s tenure.

How to Model and Gauge Leadership?

Jack Welch is a good example of the leadership skill model which is come up with by Mumford in 2000. From individual perspective, he has general cognitive ability, crystallized cognitive ability, and motivation personality. From competency perspective, he has problem solving skills, social judgement skills and necessary knowledge. As a result, seeing from leadership outcome perspective, Jack Welch has an effective problem-solving performance, such as increasing profit margin, strong confidence from investors, and most important, surging stock price for years (Mumford, 2000).

From 1981 to 2001, the company’s stock price soared from 0.0057 dollar per share to 23.2569 dollar per share in 2001, while S&P500 has increased 8.6 times and Dow Jones Industrial increased 7.2 times in the calculation above. Throughout his career, Welch has been hailed as the living example of a leader who managed to drive his employees to their full potential to push his company to unprecedented heights (Stig, 2017).

Decision on GE Capital

GE's good performance in share market is partially because of the macro-economic factor. Two external events have started stock surge. First is the American political stability as one party runs the White House and the other runs Congress, in which case stocks would rise the most. Second factor is the adventure of World Wide Web, stimulating the market emotions for over almost 14-year rise. Even though, public media still regard Jack Welch as a great leader because GE’s price was much higher than average return (Louis, 2014).

Talking about the reason for GE’s excess return, it can’t be denied that the company relied much on its financial part, which is also the by-product of its M&A strategy. M&A would not be of assistance if it distracts management’s time from fixing the core customer value equation problem — and it almost inevitably distracts (Roger, 2018). Things go well if a classic technology company using M&A to get its growth momentum when capital market is booming and investor’s mood is exciting, however, it would not be the case if the stock market has crashed. GE was commented as fallen-from-grace (Lizzy, 2017), since it was punched in its stock price in recent subprime crisis illustrated on Figure 2. Moreover, GE describes itself as “Go Big” in its annual report release notice in 2005 (GE, 2006), which showed that GE has been satisfied with its performance.

Having Missed the Era?

The main strategy Jack Welch has used to enhance its profit is innovative management. When talking about the technology and product, Jack Welch has used M&A to ensure GE has fresh blood to catch up the trend. Although Jeff Immelt has developed a large part of capital investment in research and development (R&D), GE is still lacking the innovative momentum in both sides. At least three main technology innovation has GE missed, these are consumer-level vehicle, personal computer and then smartphone technology.

- Personal Vehicle. GE has its locomotive and train business but has never entered into a consumer-level vehicle industry, which has been soared during recent decades for booming demand and increasing spendable income.

- Personal Computer. This may be attributed to the innovation shortage inside GE instead of some M&A strategic mistake. As the personal computer showed up in 1978 and World Wide Web showed up in 1994, an utter new era of communication, and moreover business, has been arrived.

- Smart phone. It is not surprised that the adventure of smartphone is so close to PC era since mobility is indispensable with the maturing transportation system. Smartphone is a succession of GE’s absence in PC field.

With all the hardware markets in an insufficient deployment, GE definitely lacks the infrastructure to enter into digital era since PC, smart phone, Internet and big data are a set of chain process. Although GE has almost finished its digitalization, it seems so rigid to incorporate new digital system into its traditional business. More importantly, without proper front steps, the transformation project would undoubtedly costly and time-consuming. In fact, GE has built its own team to launch the transformation (McKinsey, 2015). This is the shortcoming for Jack Welch’s approach, which has put so many efforts on management innovation and aggressive M&A instead of looking out of the window to seek new technology.